HO CHI MINH CITY -- Southeast Asia's biggest lending startup sees a cautionary tale in China, where a decade of freewheeling growth in digital loans collapsed spectacularly under the weight of frauds and crackdowns.

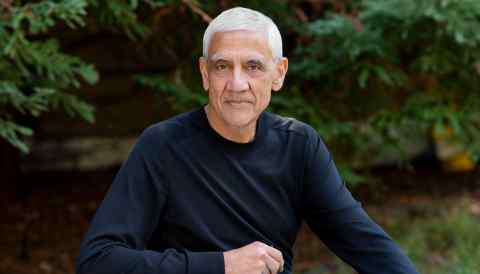

The region has benefited from "preemptively regulating" against bad actors, says Funding Societies, a Singapore-based company that has raised $144 million from investors led by SoftBank Group. And that is why CEO and co-founder Kelvin Teo would be happy to see even more regulation -- to a degree.